Give the gift of a secure financial future.

As parents and grandparents, we always want the best for our children. For most of us, that means helping them get a path to success. One of the most meaningful ways to do that is by providing the financial safety net that comes with a Bright Start plan. What are Bright Start plans? It’s about securing their future and giving them a strong start in life.

Why a Bright Start plan?

Bright Start plans offer many benefits that can help secure the child’s future. It’s a great tool to ensure that whatever the child dreams, they can also make it happen. Here’s why it makes a great investment:

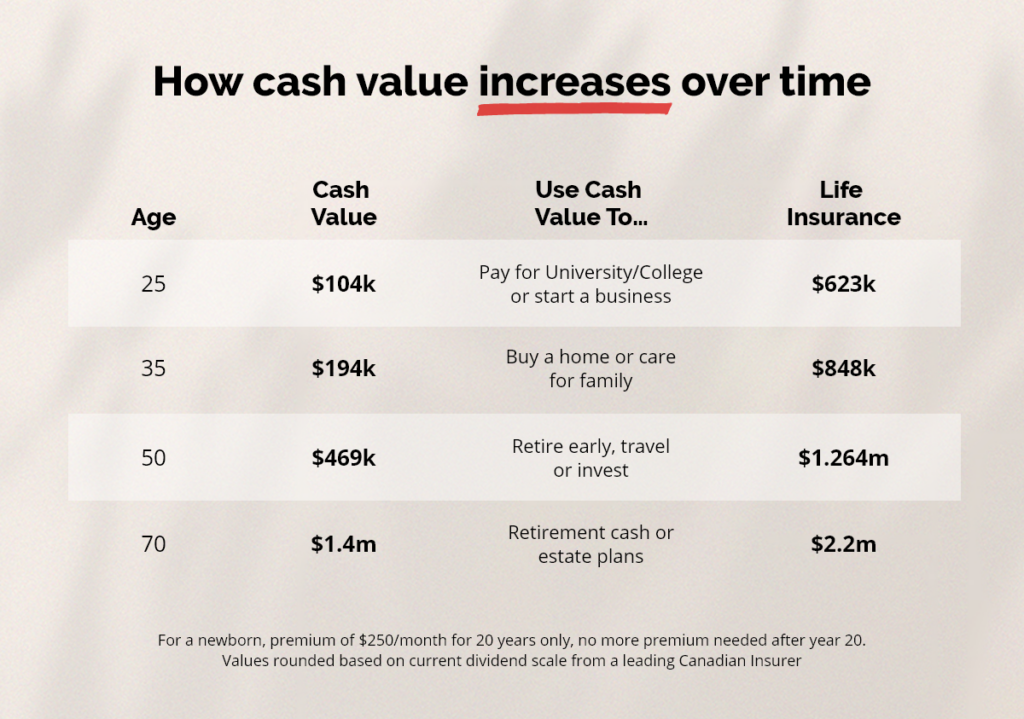

- Cash Value Buildup: The policy builds up a cash value over time. This cash reserve can be used for key moments in their life, such as paying for college tuition, making a down payment on their first home, starting a business or even funding their wedding.

- Payoff Periods: You have the option to choose a payoff period that suits your financial situation. The policy can be fully paid off in 8, 10, or 20 years, ensuring that the child won’t have to worry about payments once the policy is handed over.

- Tax Advantages: Policy ownership is transferred to the child tax-free when they reach the age of majority. This means there are no taxes when the policy is handed over.

- Increase Coverage & Add-Ons: The policy allows you to add disability coverage at the start. As the child grows, you can increase the coverage amount and add critical illness coverage.

- Lifetime Coverage: By investing in a Bright Start plan, you’re not only helping them cover costs they may not be thinking about now, but also providing them with a valuable asset they can cash out as per their needs. Plus, they’ll have whole life insurance coverage.

You Have Control

As the policyholder, you have control over the policy. There are ways to hand over ownership when the child becomes an adult. You also have the flexibility to choose the coverage amount based on the premium amount you’re comfortable investing.

Secure Their Future Today

Give your child a strong base to start their life and set them up for success. With a Bright Start Plan, you can ensure they have the financial security they need to navigate life’s milestones.

Don’t wait. Take 15 minutes today to talk with an advisor about this valuable gift for your child. Call us at 1-800-709-5809 or book an appointment below. Secure their future today with a Bright Start Plan.